What is investment decision analysis?

Decision analysis, in short DA, is the discipline comprising the philosophy, theory, methodology, and professional practice necessary to address decisions in a formal manner. DA includes many procedures, methods, and tools for identifying, clearly representing, and formally assessing important aspects of a decision. DA helps in systematically comparing decision alternatives, and recommending a course of action following a conditional optimization of the ‘utility’ of a well-formed representation of the decision. Ultimately, this formal representation of a decision and its corresponding recommendation is translated into insight for the decision-makers and other stakeholders. Technological innovation, such as in DESTRESS, can add value to a possible course of action (e.g. a specific stimulation technique) by improving its expected utility (e.g. the mean of the Net Present Value distribution) and/or reducing the possible range of bad outcomes.

Why is it Important to Relate DESTRESS Research Results to Investment Decision Analysis?

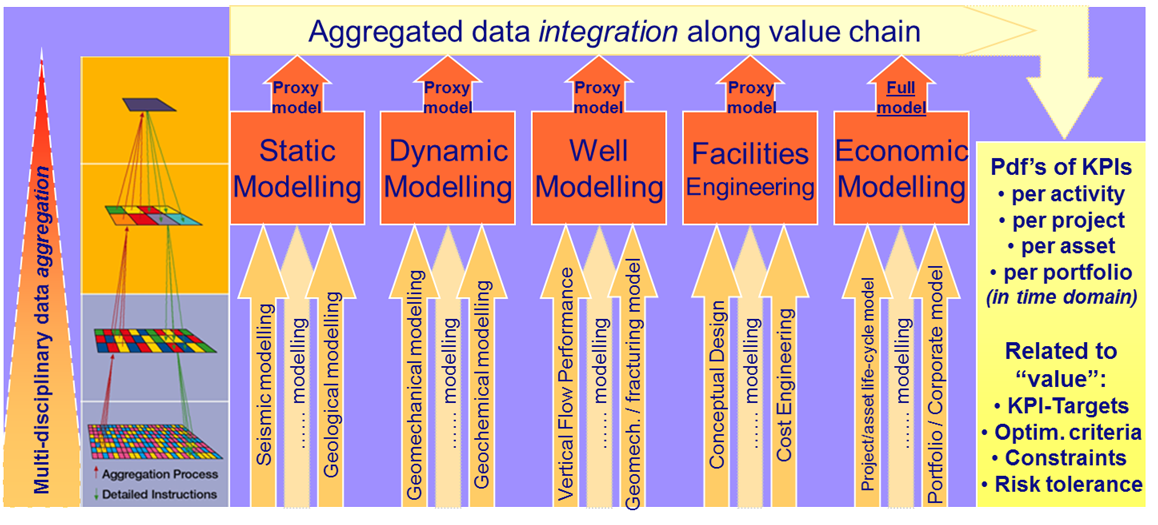

Researchers in a joint project need to develop a common language through which they can express their added value in terms of improving the risk and reward of investment or operational business opportunities. Such common language also provides a framework for comparing decision-alternatives in a consistent way, thereby giving insight to decision-makers. Given an integrated technical-to-business model, uncertain model input variables should first be specified as probability density functions (pdf’s), which give a frequency distribution within the uncertainty range. Next, the model is run using the Monte Carlo sampling process and histograms of the model’s output-KPIs (Key Performance Indicators, i.e. decision metrics such as Net Present Value, Internal Rate of Return etc.) can be computed (Figure 1).

These output-histograms represent the uncertainty in the project’s forecast performance from which the project’s expected utility and risk can be computed (risk = probability of an undesired outcome multiplied by the value of the undesired outcome). Given the prior knowledge (i.e. before doing the research) on input variables (expressed as a priori pdf’s) and on the relationships between the model’s input variables governing the system’s state-variables, researchers should update the model with the new pdf’s and relationships resulting from their research. Thus, they can demonstrate, for a particular case study, their added value in terms of updated KPI-histograms (Figure 2). The method is generic, enabling the multi-disciplines to speak the same language, integrate their findings into a common formalism and assess the added value of their new research.

How in DESTRESS Should one Translate Research Results to Input for Decision Analysis?

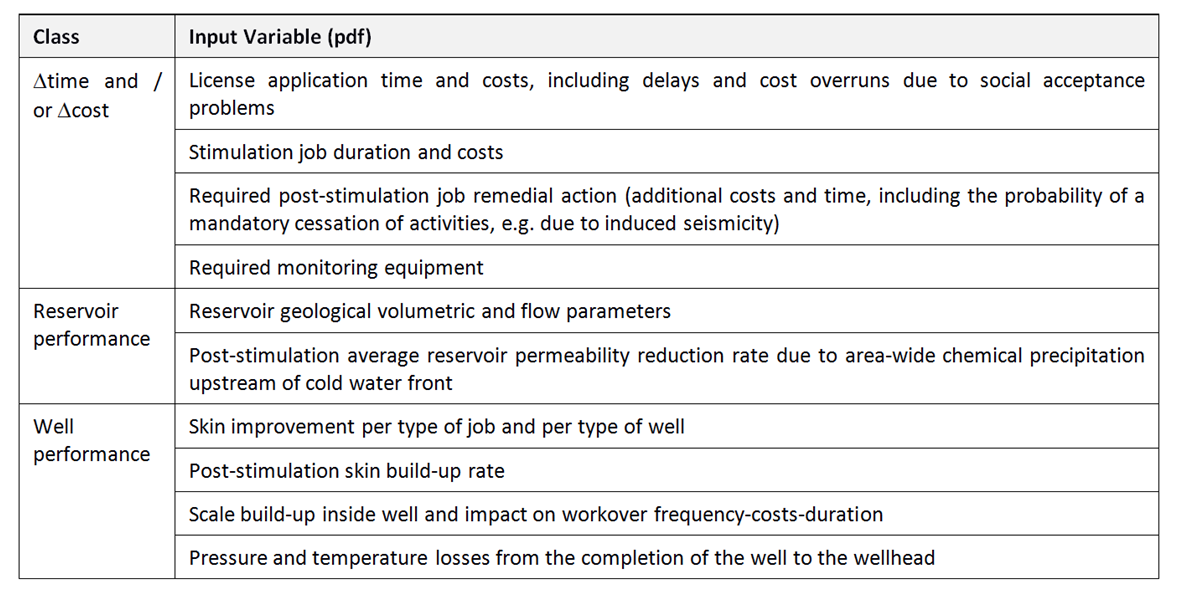

For all types of soft stimulations techniques, i.e. Cyclic Stimulation, Multi-stage Stimulation, Chemical Stimulation and Thermal Stimulation, we need a methodology that allows a consistent evaluation and comparison between the various stimulation alternatives. This method must also include uncertainty and risk analysis, as de-risking (risk reduction) is often a primary driver for deciding whether or not to invest in some opportunity. Examples of model input variables (to be expressed as probability density functions) that impact on the decision criteria of a stimulation job are given below:

To this end, one may have to account for any volumetric upscaling effects to translate detailed laboratory experiments to the size of the geothermal well’s drainage volume. In terms of relationships between the input variables, simplified / limited validity correlations can be supplied to the business model as “proxies” (Figure 3) of more detailed models. An example is the correlation obtained from reservoir simulation studies of heterogeneous, non-idealized drainage patterns to quantify how the temperature of the produced water declines following breakthrough of the re-injected, cooled (and only partially re-heated) water into the production well. This temperature depletion will affect the power conversion at surface and, hence, the life-cycle economics of the project under study.

Reviewers

Henk Krijnen, expert in decision analysis, board member of the European Decision Professionals Network and president of Navincerta

Holger Cremer, TNO

Sören Welter, EnBW

References

Decision Analysis: Applied Decision Theory

Proceedings of the Fourth International Conference on Operational Research, Wiley-Interscience by Howard, R.A., 1966

A framework for Uncertainty Quantification and Technical-to-Business Integration for Improved Decision-Making

In SPE94109 presented at the SPE Europec Conference in Madrid, Bos, C.F.M., 2005